Risk evaluation and investment decision making

Knowing and understanding all possible risks shall motivate investor to more brave actions. Knowing the risks does not mean that all bad things really must happen, a risk might even turn into a reward. Successful risk management is the cornerstone of successful long-term financial asset management. In Switzerland, solid risk management is the most important element of bankers' and investment managers' daily business and a distinguishing part in Swiss business culture.

In our previous article “Risk Analysis: how important is it for your investment?” we talked about major risks that investor shall evaluate before making decision on investing in a certain asset or financial instrument. In this article we will consider some other risks and see how they can be evaluated.

Inflation Risk

Inflation risk means that the rate of inflation could exceed the rate of return (yield) on an investment. This risk is to some extend linked to currency risk.

This is an important risk when evaluating possible investment in fixed-income instruments like bonds and term deposits. As the interest rate of these instruments is normally fixed until maturity, the investor will get a constant interest payment until the principal is repaid. Should inflation rise, his nominal profit will stay the same. However, he will be repaid with money with reduced buying power, so in inflation-adjusted terms he might suffer a loss.

Inflation risk must be taken into account when comparing the returns of fixed-income instruments denominating in different currencies. For example, at a certain time, Swiss state-guaranteed bonds with 5-year maturity, denominating in Swiss Francs, paid 1.5% interest per year. With an inflation rate of only 0.3%, the inflation-adjusted real rate of return (that's what the investor effectively earns) is 1.2% per year. In contrast to this, Russian state bonds with similar maturity, denominating in Russian Rubles, paid an annual interest of typically 7.8% (OFZ 26204). But with an official inflation rate of 9.8% p.a. (Rosstat, 4.Q/2010), the inflation-adjusted real rate of return was a negative -2.0%. This means that, even while the nominal interest rate of Russian state bonds was more than five times higher than Switzerland’s, in inflation-adjusted figures an investment in Russian state bonds would produce a loss of capital equal to 10% of its start value over 5 years, while the investment in Swiss bonds will gain more than 6% in the same period.

Inflation risk is quite difficult to hedge by means of pure financial instruments. There are some kinds of inflation-linked bonds like the US-American "TIPS" (Treasury Inflation-Protected Securities) on the market, whose interest rates vary according to some offical inflation index. But the best method to avoid this risk is to invest in economies with a history of financial stability and low inflation and/or chose an investment in inflation-resistant assets like corporate shares, precious metals or real-estate.

Fixed-Income Price Risk

Earlier we have learned that fixed-income instruments like bonds and debt notes carry no market price risk. However, this is true only in the case that we will hold these instruments until their respective maturity date.

The price of bonds follows a strict mathematical relation to the interest rate, or to be more precisely, to their yield. Should the interest rate rise after we bought the bonds, the market price of the bonds will fall correspondingly. This is important only in the case that we want to (or need to) sell our bonds before they will be repaid by the issuer. If we keep the bonds, as originally intended, until their maturity, nothing will change for our expected profit.

The price of bonds can also decrease, if the credit rating of the issuer is lowered. This will automatically imply higher interest rates, and in the following the bonds will fall. Here also, the problem is relevant only if we want to sell before maturity.

Hedging against fixed-income price risk is possible with specialized derivate instruments. However, the cost of hedging is substantial and can considerably reduce the net profit of the investment.

This why Benesteem company always advises its clients investment strategies where fixed-income instruments are held until they mature. This is the standard investment procedure recommended for that type of instruments, and in this case the price risk can be neglected.

Geopolitical risk

Geopolitical risk comprises all kinds of politically motivated or politically originated actions and developments, which could have a negative impact on an investment or the outcome of a business operation.

Notorious historical examples of geopolitical risk in the 20th century are the Russian Revolution and the period of the so-called Third Reich in Nazi Germany, which not only destroyed the fortunes and presumably safe assets like real-estate property, but in countless cases also the lives of those to whom these assets belonged.

Expropriation of commercial investments can still happen nowadays, even in previously business-friendly jurisdictions. The nationalization of the oil industry in Venezuela some time ago is an example of recent times.

But even less drastic measures than expropriation can have an adverse effect on financial investments. Local corruption, over-taxation, inefficient bureaucracy, defects in infrastructure and an unreliable juridical system could all result in reduced returns or even substantial losses of our investments. These kinds of risk are not limited to developing markets, offshore jurisdictions and so-called third-world countries only. Even in the world's most developed economies, ever-changing tax laws and erratic government policies can make reliable long-term investment planning difficult. Germany's current policy on energy or Great Britain’s taxation of the financial sector are examples for this.

Another important risk factor is the possibility of currency transfer controls, which would restrict or limit the repatriation of profits or capital from the offshore jurisdiction back to the holding structure. Such restrictions could, and have been in the past: "Asian crisis" 1997/98), Cyprus crisis in 2013.

Geopolitical risk cannot be hedged by means of financial instruments. It must be avoided from the beginning by selecting only those countries and jurisdictions for strategic investment, which have a proven track record of social and economic stability and democratic government reliability. Otherwise only short- or medium-term investments should be considered.

Value-at-Risk (VaR)

Value-at-Risk, or short "VaR", is a risk analysis metric to indicate how much money we could probably lose with our investment during a given period, if all things turn bad against us. This definition is a little bit simplistic but it hits the point, and the VaR is an important and widely used indicator to quantify the risk of a financial investment.

In reality the calculation of the VaR is a quite complex process and requires a lot of information, experience and specialized computer software. When interpreting a VaR value, we must take in account the period, or "horizon", for which the VaR had been calculated. This horizon must fit the time intervals, in which the investment manager monitors the performance of our investment and could take corrective actions, if necessary. For long-term fixed-income investments, the horizon would be set to a week or a month, or even longer periods. For actively traded portfolios, the horizon is typically one trading day.

The second important parameter of VaR is the so-called "confidence interval", which indicates the probability that any possible loss will stay within the limits of the VaR. Example: A "99% 1-week VaR = 1.7%" would mean that, if all things go bad, our investment will not lose more than 1.7% of its value within one week, and only a minimal chance exists that the loss could be even greater than this.

VaR values must be interpreted with respect to the investment strategy. While a 1-week VaR of 1.7 is very good for a growth-orientated stock market portofolio, it would be a quite bad number for a conservative sovereign bond investment.

In any case, Value-at-Risk gives the investment manager a valuable tool to assess the risk of a given investment. Its ease of reading also enables the client to have a good understanding of the amount of risk he is going to take.

Types of risks that we talked about in our two articles are major ones. In reality, the list of possible risks is much wider. Then, what shall potential investor do knowing about such a long list or risks? Not to invest at all? In fact, knowing and understanding all possible risks shall motivate investor to more brave actions! Knowing the risks does not mean that all bad things really must happen, a risk might even turn into a reward! A currency risk can also work to our advantage, there are even specialized investment instruments to profit exactly from those risks. It's like planning an alpine climb in our Switzerland mountains. If you know what challenges lay on your way and where potential dangers await you, you can prepare accordingly and have a good chance of making it to the summit.

Successful risk management is the cornerstone of successful long-term financial asset management. In Switzerland, solid risk management is the most important element of bankers' and investment managers' daily business and a distinguishing part in Swiss business culture. This does not mean that a Swiss financial manager will never take any risk in his decisions. However, by appropriate risk analysis and risk management techniques, he will always know for sure what could be the maximum possible loss under the worst-case scenario. Knowing this risk, the investment manager and his client can weigh the risk versus the profit and decide on the optimum asset management strategy to best serve the client.

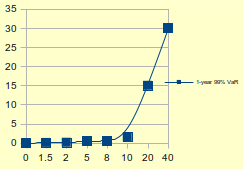

An important metric to gauge the risk of an investment is the so-called "1-year 99% VaR" value. This value indicates, how many percent of your capital could be lost with a specific investment strategy under worst-case conditions (eg. an international economic crisis, a large state default oder a major war) over a period of 1 year. All these numbers imply of course that the investment manager adheres to the principles of sound risk management and performs an active risk hedging.

The following diagram shows the relation between the typical yield per year (in %) and the 1-year 99% VaR (in %):

It can be clearly seen that the higher the possible profit, the higher is the worst-case risk. This relation is non-linear, that means the maximum risk increases disproportionately with high yield targets. As long as the yield target is below 10% (as with low-risk fixed income strategies), the maximum risk of the investment stays very low. If we want higher profits, we must switch to actively traded strategies with stock market and commodities investments, which of course show considerably higher risk levels.

It should be noted that profits are based on a portofolio calculated in Swiss Francs (CHF). With an annual inflation rate of 0% (April 2017).

Diagram was taken from essay “Private Financial Asset Management - Risks, Rewards and Strategies”prepared by Benesteem’s Head of Investment Management DI Ulrich Knappe in 2011. At that time safe haven investments including sovereign bonds or corporate bonds of investment grade received 3-6% return a year. As we all know, these good times are far in the past. But it is interesting that the basic view of diagram hasn’t changed since then. The only difference is that the line will be continued to the left, showing -1% return with even higher level of risk!

In most cases, a client's portofolio will be partitioned into two or even more segments, which each segment managed according to a different strategy. This allows for instance to earn a stable, continous income for the client through a low-risk fixed-income strategy, while at the same moment keeping the chance to grow the portfolio by taking some controlled risk in the stock and commodities markets.

Of course, this depends on the total size of the portfolio, the client's future financial plans and his attitude towards risk in general. A good investment manager will discuss these matters with his client, recommend and chose the right mix of strategies and review and adapt this mix in the future, should the need for this arise.

For more information on this issue you can click “Ask the experts” button below.

Acknowledgement: Glagoliza News thanks Benesteem Executive Consulting Service, Switzerland for providing expert information on this issue.

|

Ask the Experts! |